Biweekly mortgage calculator with taxes and insurance

So if at all possible save up your 20 down payment to eliminate this. This is also calculated using the.

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Once the equity reaches 20 of the loan the lender does not require PMI.

. Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer. Biweekly Mortgage Calculator Mortgage calculator with PMI terms. Life insurance quotes.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. These taxes together are called FICA taxes. Adding Subtracting Time.

For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments. If you pay half of your. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

That moment can be calculated with loan to value ratio that shows the exact date when the loans principal balance fall to 80 of the homes purchase price. Most residential mortgages were commonly structured in 5-year balloon mortgages while others were 11 to 12-year fully. Biweekly mortgage payments are a good idea under the right circumstances.

It does nothing for you except put a hole in your pocket. In the calculator the recurring costs are under the Include Options Below. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Use this biweekly mortgage calculator to compare a typical monthly payment schedule to an accelerated biweekly payment. It can be a good option for those wanting to contribute more money toward a. 1929-1933 mortgage lending was largely dominated by commercial banks life insurance companies mutual savings banks and thrifts known as Savings and Loan Associations.

The mortgage isnt the only thing homeowners pay the typical US homeowner spends over 1600 a month on insurance taxes utilities and HOA fees. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. How to Use the Mortgage Calculator.

If you work 2000 hours a year and make 50000 a year then you would drop the 4 zeros from the annual salary divide the result by 2 to get 25 per hour. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. Tips to Shave the Mortgage Balance.

With biweekly mortgage payments you make a payment toward your mortgage every two weeks. It protects the lender against some of losses. On the other hand if you want to reduce your principal faster you can go for an accelerated biweekly payment schedule.

Mortgage Calculator with PMI Taxes Insurance and HOA biweekly. Switching to a more frequent mode of payment such as biweekly payments has the effect of a borrower making an extra annual payment. Sometimes these loans are called 80-10-10 loans.

Divide your annual salary by how many hours you work in a year. Use this calculator to determine your monthly. The calculator divides your annual property taxes by 12 to calculate this monthly amount.

Compare the monthly payment for different terms rates and loan amounts to figure out what you might be able to afford. But under the wrong. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

In this scenario you take out a primary mortgage for 80 percent of the selling price then take out a second mortgage loan for 20 percent of the selling price. Multiply your biweekly earnings by 10888 to convert them into semimonthly earnings. They can save you thousands of dollars in interest and help you pay off your mortgage faster.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment.

N the total number of payments. Mortgage Calculator with Taxes and Insurance. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. This simple mortgage calculator was designed for making side-by-side comparisons of different monthly mortgage payments not including closing costs mortgage insurance or property taxes. If you make less than a 20 down payment the estimated monthly PMI.

The loan is secured on the borrowers property through a process. When you have a mortgage at some point you may decide to try and pay it off early. A biweekly payment means making a payment of one-half of the monthly payment every two weeks.

Most home loans are structred as 30-year loans which is 360 monthy payments. Free online mortgage amortization calculator including amortization schedules and the related curves. Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default.

Your homeowners insurance premium is divided by 12 to calculate this monthly amount. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the. This results in 26 payments a year instead of 24.

Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. Calculator Rates Balloon Loan Calculator. Each year has 52 weeks in it which is equivalent to 26 biweekly pay periods.

With a help of Calculator a borrower can determinate the moment when paying for private mortgage insurance is no longer necessary due to the amount of money that was already paid. A mortgage allows the option of building up a cash account. When a down payment is less than 20 percent home value the borrower must buy private mortgage insurance PMI.

Extra Payments In The Middle of The Loan Term. Are you starting biweekly payments in a middle of a loan schedule. Check out the webs best free mortgage calculator to save money on your home loan today.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. You can change the payment frequency. Some second mortgage loans are only 10 percent of the selling price requiring you to come up with the other 10 percent as a down payment.

These figures are exclusive of income tax. Our calculator includes amoritization tables bi-weekly. One option to consider is a biweekly every two week payment plan.

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments. A monthly payment is multiplied by 12 resulting in 360 payments. The HOA fee is included here if applicable.

A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments. Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest. Property taxes home insurance HOA fees and other costs increase with time as a byproduct of inflation.

Mortgage Calculator With Pmi Mortgage Calculator

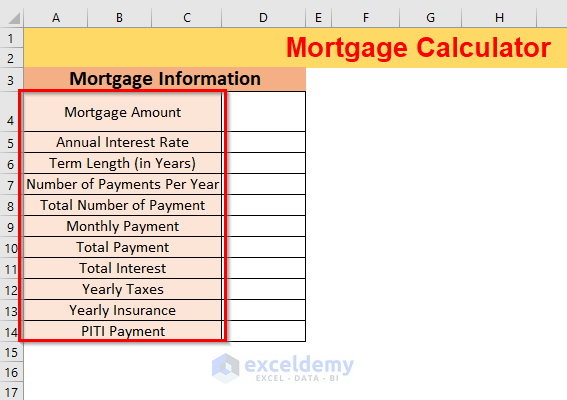

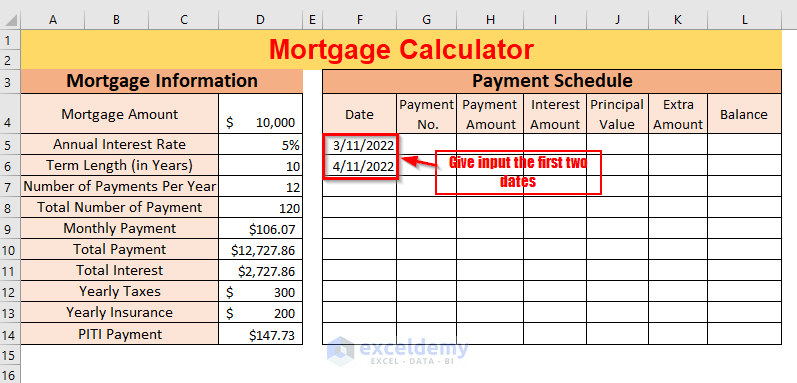

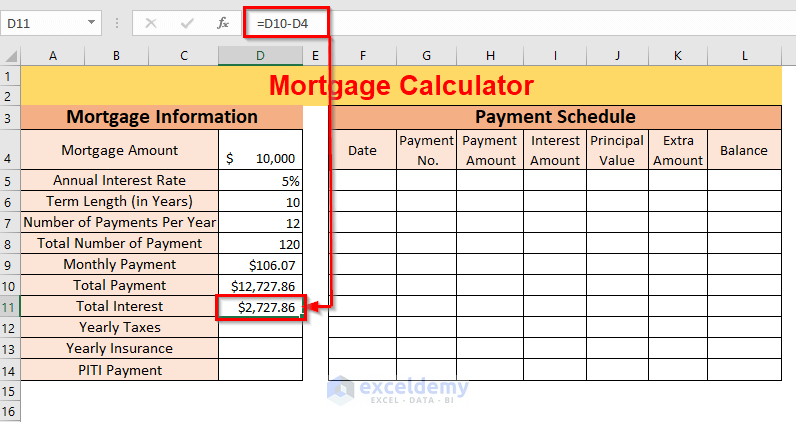

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Home Mortgage Calculator Demo Youtube

Mortgage Calculator With Taxes And Insurance

Mortgage Calculator With Pmi Mortgage Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator How Much Monthly Payments Will Cost

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Mortgage Calculator With Bi Weekly Payments

Top 10 Free Mortgage Calculator Widgets

Biweekly Mortgage Calculator

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Mortgage Calculator Money

Interest Only Mortgage Calculator Freeandclear

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Piti Mortgage Calculator With Jaw Dropping Work Hour Feature